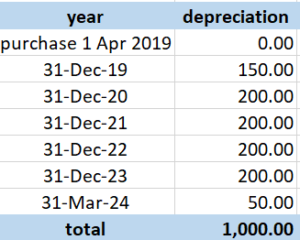

Calculate depreciation on laptop

Using straight-line depreciation they lose about 20 of their value each year. 22 Diminishing balance or Written down.

Depreciation Rate Formula Examples How To Calculate

Now comes the various methods for calculating depreciation.

. Depreciation rate finder and calculator. Days shortcut method claimed 121 days. 264 hours 52 cents 13728.

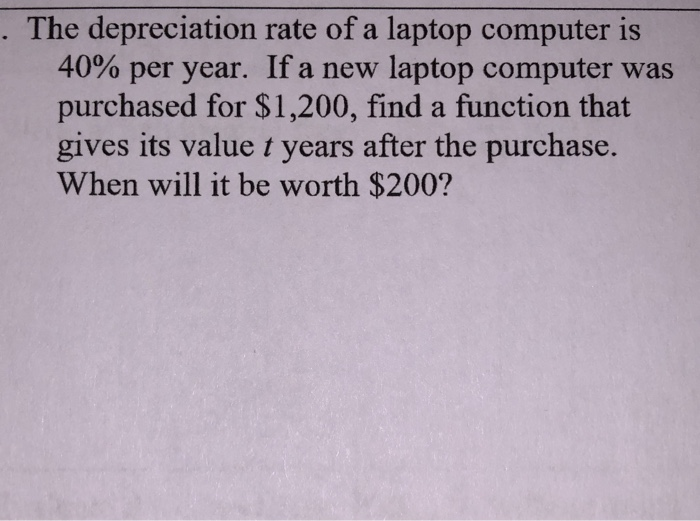

Divide the depreciation base by the laptops useful life to calculate depreciation. Notebook PCs are classified as 5-year property by the IRS for tax purposes. Assuming that the useful life for a laptop is three years the depreciation rate stands at 333 but not for the first and final year.

The tool includes updates to. In the used computer marketplace. Mobileportable computers including laptop s tablets 2 years.

2 Methods of Depreciation and How to Calculate Depreciation. Hence the depreciation expense for 2018 was 8500-500 15 1200. First one can choose the straight line method of.

Divide the depreciation base by the laptops useful life to calculate depreciation. 98770 366 121 days 365 days 66297. Deduction for decline in value days the shortcut method used.

So simple depreciation is the easiest one to go. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method. SYD depreciation Method Yearly Depreciation Value remaining lifespan SYD x.

Section 179 deduction dollar limits. 66297 30 work-related. This depreciation calculator is for calculating the depreciation schedule of an asset.

All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. Please resend the purchase document of the laptop along with the letter from the company stating that you use the laptop 100 for work purposes when sending the calculation. Where the cost is more than 300 then the depreciation.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. View the calculation of any gain or loss. To work out the decline in value of his desktop computer Colin elects to calculate the.

2 x 010 x 10000. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë.

This limit is reduced by the amount by which the cost of. Therefore Company A would depreciate the machine at. Useful life of the asset.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Where NBV is costs less accumulated depreciation. There are really two that Ill go through simple and double-declining balance.

Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3. 80000 5 years 16000 annual depreciation amount. Calculate depreciation for a business asset using either the diminishing value DV or straight line SL method.

In the example 455 divided by three years equals 1516 a year of depreciation. Before you use this tool. Divide step 2 by step 3.

Not Book Value Scrap value Depreciation rate. Computers and computer equipment. First we want to calculate the annual straight-line depreciation.

Beautiful Tire Shop Business Card Check More At Https Limorentalphiladelphia Com Tire Shop Business Card

Calculating Depreciation How It S Done Ionos

Book Value Vs Market Value Top 5 Best Comparison With Infographics Book Value Market Value Books

What Is Straight Line Depreciation Yu Online

How To Use R Shiny Language In Machine Learning Machine Learning Applications Machine Learning Data Science

Sat Math Multiple Choice Question 308 Answer And Explanation Cracksat Net

Depreciation Formula Calculate Depreciation Expense

How To Handle Tangible Fixed Assets Changing Tides

Achive Your Goals To Become An Expart On Machine Learning Machine Learning Data Science Science Method

Ever Wondered What Life Is Like For An Engineering Student Openletter What Is Life About Engineering Student Open Letter

Depreciation Rate Formula Examples How To Calculate

Method To Get Straight Line Depreciation Formula Bench Accounting

How To Calculate Depreciation

How To Calculate Depreciation Legalzoom

Solved The Depreciation Rate Of A Laptop Computer Is 40 Chegg Com

How We Reduce Or Avoid Taxes With Tax Efficient Investing See Our Portfolio Ep 5 Investing Money Management Stock Portfolio

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Accounting And Finance